In-Depth Reflection: Unraveling the Real Pain Points in Cross-Border Pet Supplies Trade Cooperation

Global cross-border trade in pet supplies—spanning pet beds, GPS-enabled harnesses, freeze-dried pet treats, and waterproof dog coats—has witnessed exponential growth over the past decade, fueled by rising pet humanization trends and e-commerce expansion. Yet behind this booming market lies a labyrinth of unaddressed pain points that erode trust and efficiency between Chinese manufacturers and overseas partners—issues far deeper than surface-level challenges like pricing or delivery delays.

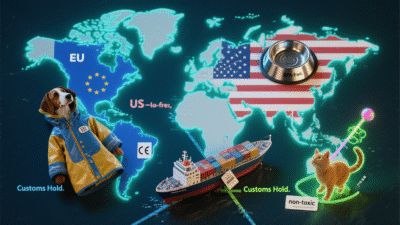

The first and most crippling pain point is regulatory fragmentation. Unlike standardized industrial goods, pet supplies cover diverse categories with wildly divergent compliance rules. A waterproof dog coat must meet the EU’s CE waterproofing standards, while freeze-dried duck treats require adherence to the U.S. FDA’s AAFCO nutritional labeling and the UK’s novel food regulations. Smaller overseas retailers often lack expertise to navigate these ever-evolving norms: a shipment of stainless steel pet bowls might be detained at U.S. customs for missing “BPA-free” engravings, or a batch of interactive cat feather wands rejected in the EU over uncertified non-toxic glue. For Chinese manufacturers, adapting to dozens of regional standards adds massive overhead: retooling production for EU-approved recycled-polyester pet blankets vs. U.S.-certified chew-resistant nylon dog toys forces tough choices between compliance and scalability.

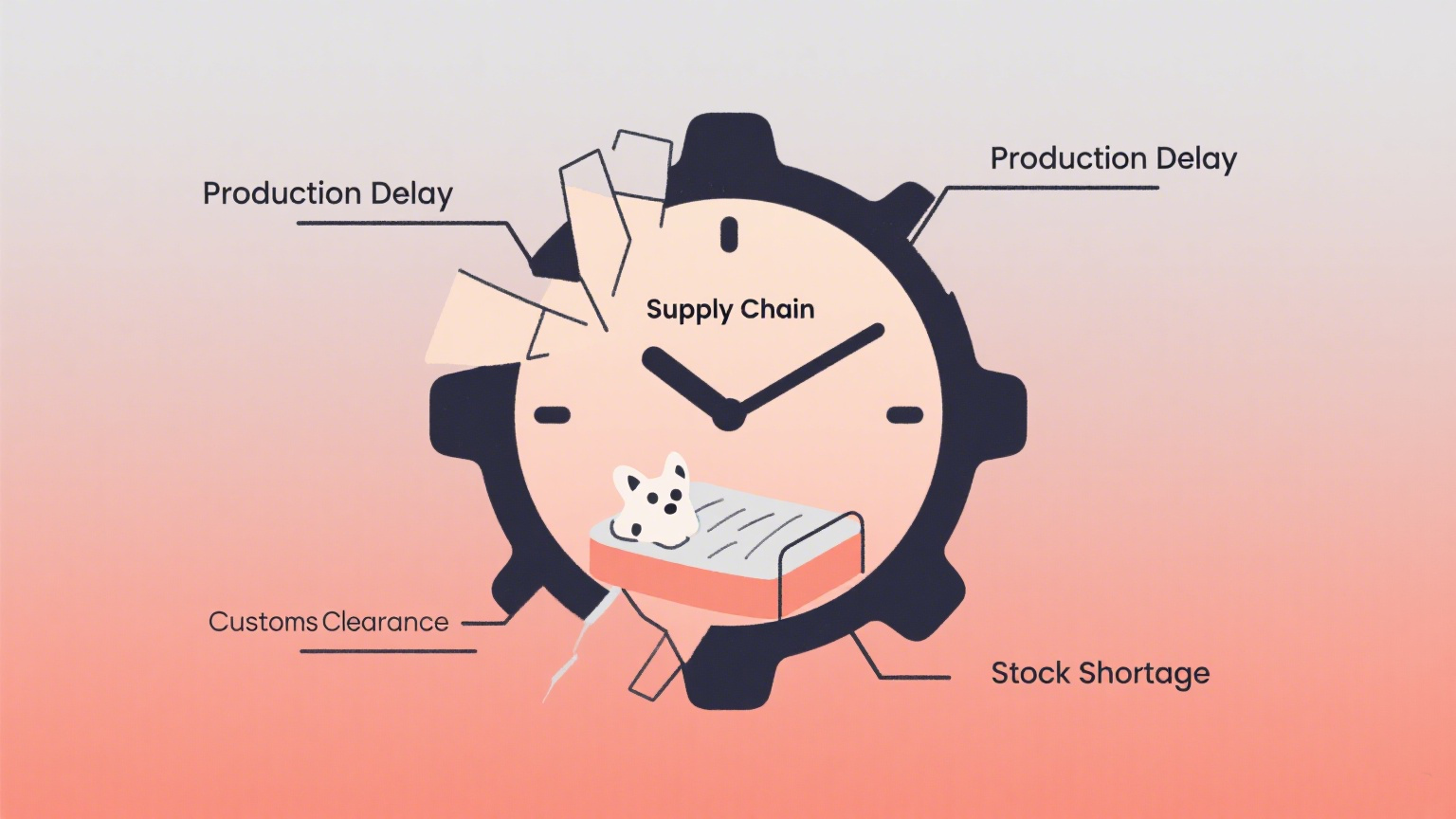

Supply chain vulnerability, amplified by the uniqueness of pet products, is another hidden hurdle. Perishable items like chilled raw pet food depend on uninterrupted cold chains, which collapse easily during port congestion or energy shortages—turning entire shipments into waste. Even non-perishables suffer: silicone pet feeding mats rely on ethylene-vinyl acetate (EVA) whose prices swing with global energy markets, leaving manufacturers stuck between honoring fixed-price contracts for wooden pet houses and absorbing losses. Last-mile delivery compounds issues too—bulky items like foldable pet playpens often face limited courier options in remote regions, while fragile ceramic pet dishes risk breakage in transit, leading to customer complaints that strain manufacturer-buyer relationships.

Worst of all is cultural and demand misalignment. Chinese factories excel at cost-effective, functional products but often miss regional nuances: Europeans prioritize organic wool-lined dog sweaters, while North Americans crave smart pet feeders with app connectivity. Neon-patterned plastic pet carriers that sell in Southeast Asia may gather dust in Scandinavia, where muted matte finishes are preferred. Urban Japanese buyers need compact wall-mounted cat shelves for small apartments, while Australians demand UV-resistant outdoor pet beds—customization needs that clash with manufacturers’ desire for economies of scale.

These pain points demand more than quick fixes; they require collaborative rethinking. Buyers must share market insights (e.g., “Scandinavian consumers want minimalist ceramic pet bowls”) and invest in regulatory literacy, while manufacturers need flexible production lines for items like interchangeable pet toy parts. Only by addressing these root issues can cross-border pet supplies trade move from fraught transactions to sustainable partnerships.

https://shorturl.fm/7URAo

Hi I am so excited I found your weblog, I really found you by mistake, while I was searching on Yahoo for something else, Regardless I am here now and would just like to say thank you for a tremendous post and a all round enjoyable blog (I also love the theme/design), I don’t have time to read through it all at the minute but I have saved it and also added in your RSS feeds, so when I have time I will be back to read much more, Please do keep up the superb job.

зеркало leebet